13 October 2020

This blog explains why and the way to use Plaid for bank payment over the manual bank payment process.

Introduction to Plaid

Plaid is a technology platform which enables applications to attach with a user’s checking account, eliminating the necessity for users to enter the account and routing numbers or cope with micro-deposits which is an error-prone process, that is hard for users and forces businesses to withstand through sensitive information on their own systems.

Key Advantages of using Plaid

- Instant ACH authentication: Automated Clearing House (ACH), is a secure bank payment transfer system that coordinates inland Electronic Fund Transfer (EFT) transactions and connects all U.S. Banking channels.

- Account Information: Get the bank account information that is connected to Plaid

- Transaction Data: Audit account and transaction data

- Balance Check: Real-time balance checks

How to start?

Step 1: Register on the Plaid website

- First, Register on the Plaid website with this link (https://dashboard.plaid.com/signup), it is free for a sandbox mode.

- Login to dashboard > Account > Keys

- Collect sandbox API key, client_id, public_key, secret key

Step 2: Install Plaid Library

- Install the Plaid library in your Project using Nu-Get Package Manager for interacting with Plaid banking APIs.

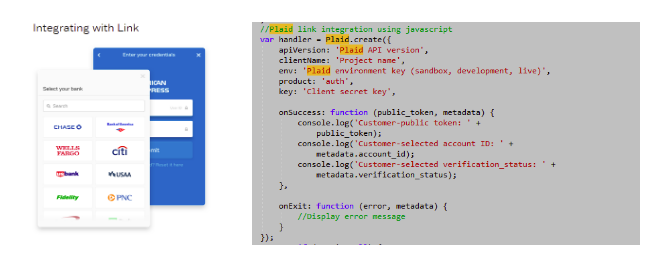

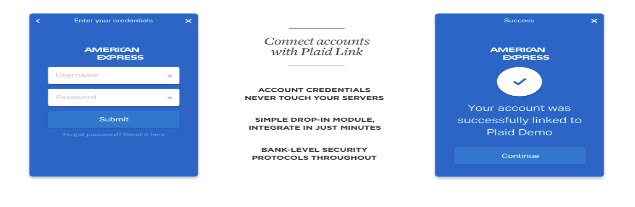

Step 3: Integrate Plaid link

- Plaid Link is the easiest way to integrate with the Plaid API. Plaid Link is a drop-in module that handles authentication and credential verification. It works with all browsers and platforms including Android and iOS.

- Plaid.create accepts configuration objects and returns two functions open and exit.

- Open will display the “Select bank” view and close will exit from the Plaid window.

- Response: Public token, selected account ID

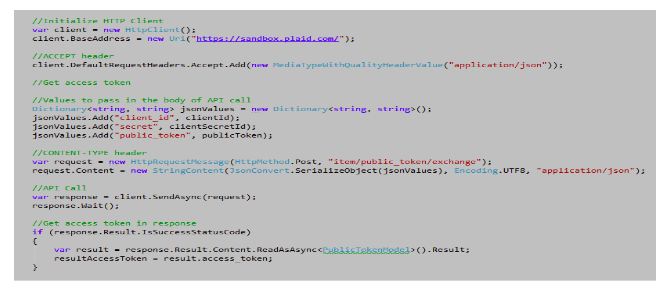

Step 4: Exchange Token flow

- Once the user has successfully logged in the Plaid link, the public token can be fetched on the client-side via onsuccess callback. The public_token is transitory and expires after 30 minutes. A public token is revoked once it has been successfully exchanged for an access token.

- API: POST item/public_token/exchange

- Response: Access token

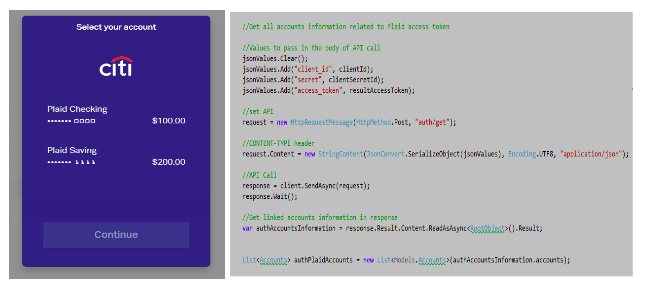

Step 5: Selected account information flow

- Bypassing the access token and the selected account Id you’ll get all the account information.

- API: POST auth/get

- Result: List of all connected verified account Ids and each account Id retrieves each account’s bank name, routing number, account number, current balance

Step 6: Use of verified account ID

- You can use this verified account ID and access token with any third party payment gateway API like Stripe for the payment.